The Australian car market is a fiercely competitive and challenging environment, with a history of new brands needing help establishing themselves and remaining sustainable. Despite this, Cupra, the Spanish car brand owned by Volkswagen, has recently entered the Australian market. As a relatively new brand launched in 2018, Cupra faces significant challenges in gaining market share and establishing a solid brand presence in a country with a strong affinity for established and trusted car brands. With a range of high-performance vehicles and a focus on innovation and design, Cupra will need to navigate the complexities of the Australian car market to succeed and build a loyal customer base.

Using Similarweb data, we took a quick look at Cupra in the Australian market to better understand their digital strategies for entering the market and how things look at this early stage.

Similarweb is a known source of web traffic data and statistics. We used the data to understand the following:

- Website traffic to the Australian Automotive Industry

- Traffic to the Cupra website

- Digital channels Cupra use for consumer acquisition

- Cross-shopping behaviours

- Web traffic to the Book A Test Drive page

Australian Automotive Industry

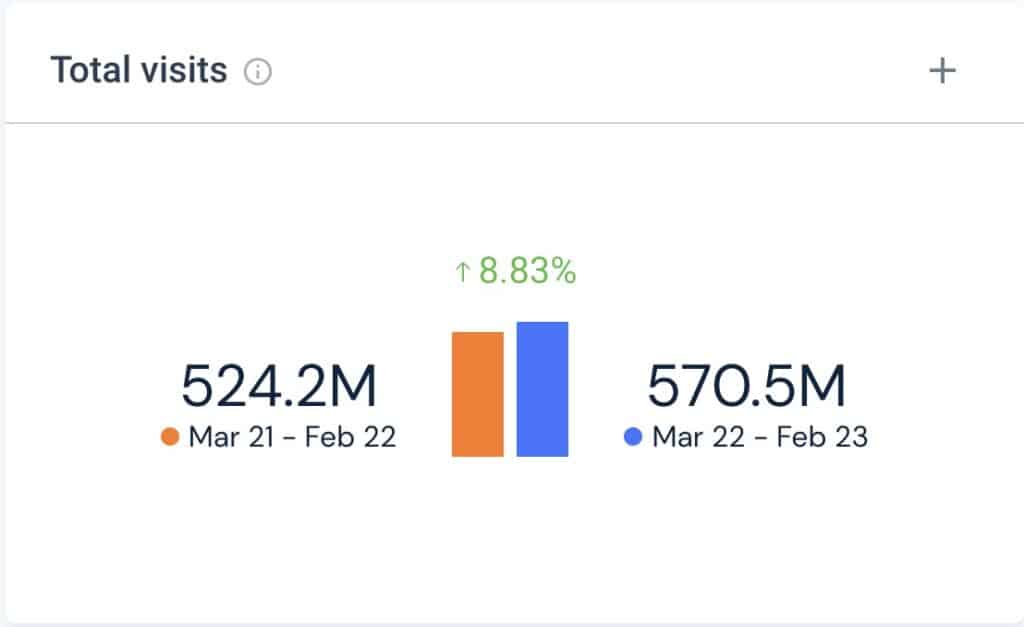

Total website visits to the automotive industry over the past 12 months have been up 8% year on year, and some of the leading websites are Carsales.com.au and Toyota.com.au, and over 50% of all traffic comes from search (organic search and paid search combined)

Bring Digital Performance implemented SEO for a fleet management company in Australia.

Web Traffic cupraofficial.com.au

Traffic to the Cupra website has increased dramatically over the past 12 months. In February 2023, traffic grew by 366% versus the same period in 2022, and the traffic trend appears to be strong over the past 12 months; however, there does appear to be a drop in traffic most recently. You would assume many factors, such as interest rates and seasonality, will impact this traffic drop.

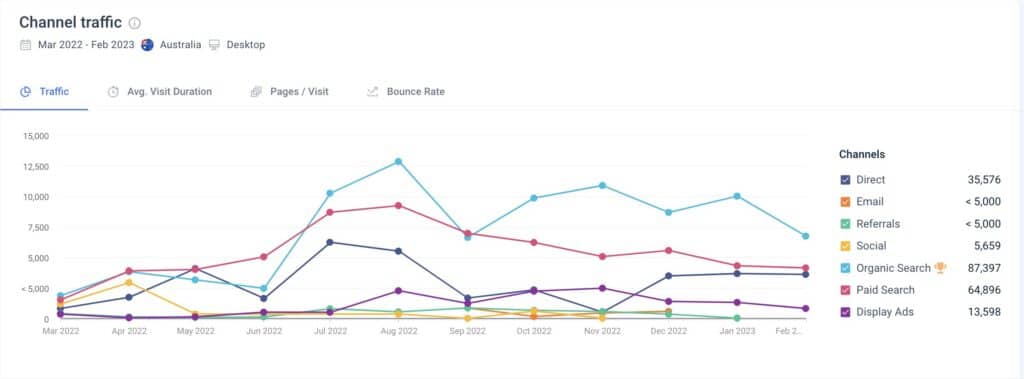

Cupra Digital Channels

According to the data, it is clear that the digital performance team at Cupra have been busy. From July 2022, they have dialled up activity across paid search and display, and traffic from organic search followed. In recent months there has been less reliance on paid digital channels, allowing organic search to acquire customers and send them to the brand’s website. Our reports suggest about 95% of all search keywords driving traffic are brand related (make and model).

Some of the non-branded search keywords working for them are:

“best medium SUV 2023”

“new SUV evs”

“best SUV”

However, the traffic for some of these terms is still low, e.g. cupraofficial.com.au had less the 1% share of traffic for “best suv” in the past 12 months.

A glance at the paid search strategy suggests they went heavy on branded search (the jury is out on whether bidding on brand is a good strategy… that’s a topic for another day). However, from mid to late 2022, there was also a healthy volume of “ev” paid search traffic. EV paid search traffic peaked in November 2022, when the brand owned almost 50% of all paid search traffic for their targeted search terms. Other brands they were competing with were Ford, Landrover and Lexus.

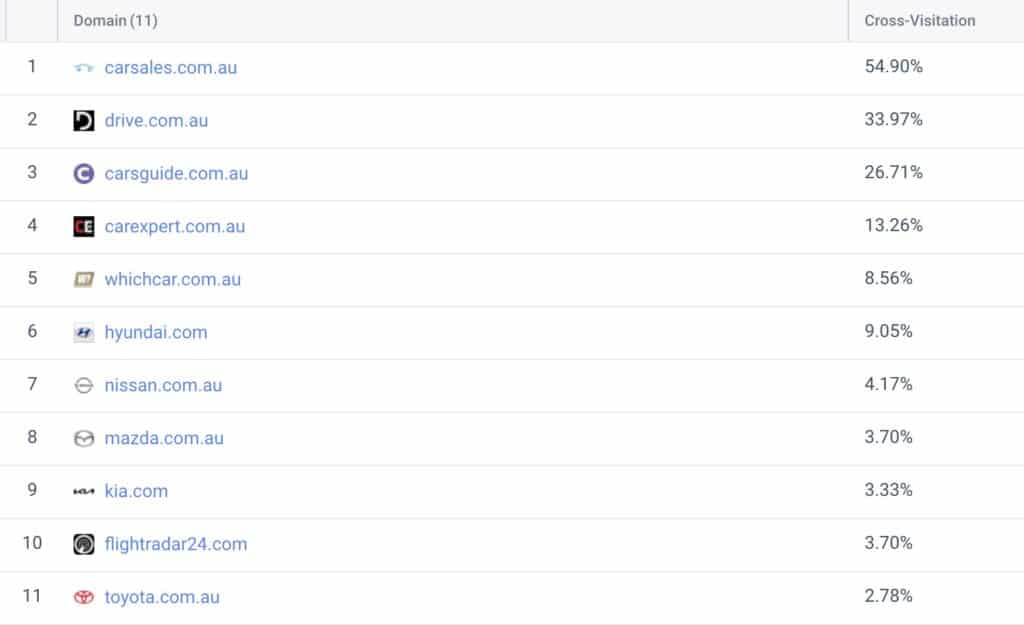

Consumer Cross-Shopping

A challenge in the automotive industry is understanding your customer’s shopping behaviours and what other makes and models they consider when looking at a new Cupra. Thankfully, we can begin to unpick this by looking at online browser behaviours, and when people look at cars on cupraofficial.com.au we can also see 9% of them on hyundai.com. Other car manufacturing websites in the data are nissan.com.au, 4% and mazda.com.au, 3%.

Cupra Book a Test Drive

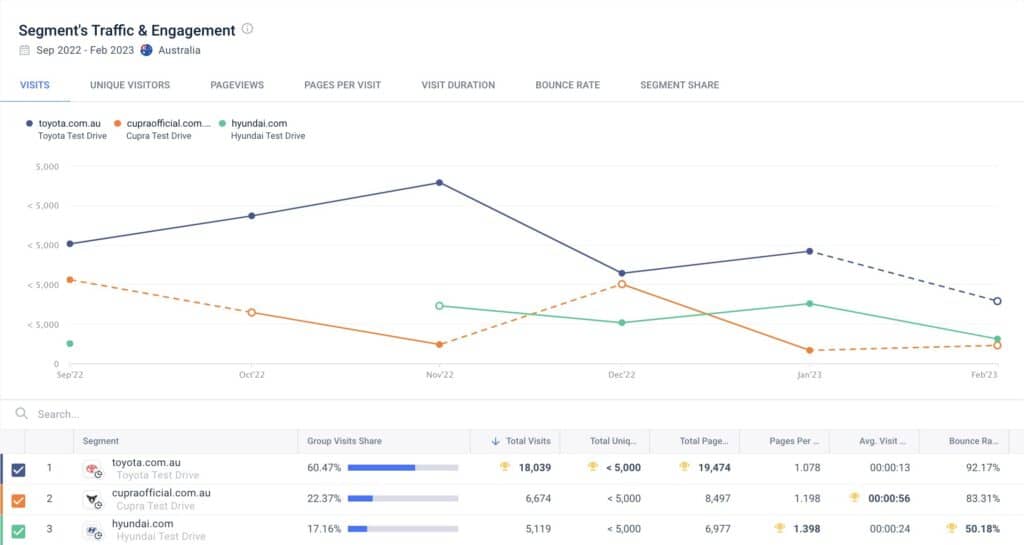

Traffic to a website is one indication of how well the brand is performing. However, there are other success indicators. A lower funnel metric to help understand how the Cupra brand performs is demand for a test drive. Like many other auto brands, booking a test drive is available on the Cupra website and using the Similarweb segment analysis tool, we can isolate traffic to this webpage (https://www.cupraofficial.com.au/test-drive). Traffic could be better, but to help provide more context, we benchmarked this against a couple of other brands, Toyota and Hyundai. All three brands have a section on the website to book a test drive.

The results are promising. Although traffic to the Cupra test-drive pages is low compared to Toyota and Hyundai, the results look promising.

Over the past six months, our data suggests:

- 18,039 Vistis to the Toyota Book A Test Drive page

- 6,674 Vistis to the Cupra Book A Test Drive page

- 5,119 Vistis to the Hyundai Book A Test Drive page

When benchmarked against a few others, the data for Cupra looks good.

What does all this mean?

Web traffic to the Australian Car Industry has increased and suggests healthy demand.

Since entering the Australian market, Cupra’s website traffic has grown significantly.

Search is the primary driver of traffic to the website (paid and organic). They began with a heavy investment in paid search early, slowly dialling this back to allow organic traffic to support the car dealers with leads.

Depending on what data you refer to, Cupra’s competitors in the Australian automotive industry include Toyota, Hyundai, Ford, Landrover, and Lexus. However, based on their customers’ browsing behaviours, our money is on Hyundai.

The results look promising if we use traffic to Book a test drive page as a KPI.

Will Cupra last in the Australian market? Only time (and data) will tell.

Would I buy one? Yup!

If you found this analysis helpful, drop us a line; we’d love to chat.