Electronic vehicles (EVs) are on the way to becoming the norm, as we develop more sustainable technology. It won’t be long before we’re all humming along in an EV, happily using charge stations to top up batteries on road trips.

At Bring, we’re always keen to learn about the latest trends. We try to stay ahead of the curve, to identify and confirm new developments. Here’s a look at one noticeable trend that has surfaced in the Australian automotive industry.

Hyundai Ioniq5 trend

The Australian automotive industry has seen a surge in consumer curiosity about one particular EV—the Hyundai Ioniq5. As car enthusiasts with a thirst for data and insights, we wanted to dig deeper to understand this behaviour.

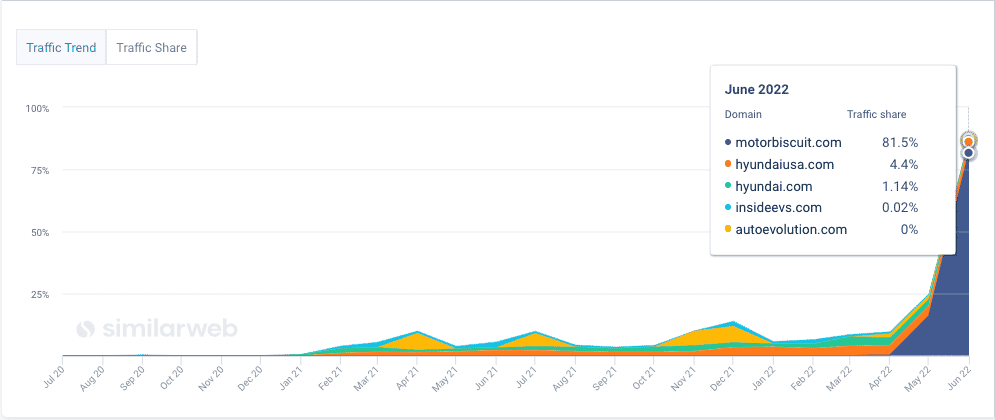

If we zoom out and look at global search traffic data for the term “Ioniq5” over the past 24 months, the Hyundai Ioniq5 has gone from zero to hero across the globe.

Global Hyundai Ioniq5 trends

From May to June, we see a dramatic spike in demand for the car, with 16% of the traffic coming from motorbiscuit.com.

The above is merely a tiny piece of the puzzle, using only one search term. But we all search in various ways, using different keywords. Thus, to get a broader picture requires data on more keywords that relate to and drive traffic.

Globally in the past 12 months, there have been 4.616 million searches for Hyundai Ioniq5 plus 200 variations of the term. For the most part, Hyundai domains have been the top recipients of this traffic. However, looking under the hood reveals more data about Australian customer behaviours, the content they consume, and their paths to purchase.

Australian Hyundai Ioniq5 trends

The following analysis pulls traffic data from 200 Ioniq5 keywords. The top 5 keywords are:

| Search Keyword | Share Of Traffic |

| hyundai ioniq 5 | 36.62% |

| ioniq 5 | 24.36% |

| hyundai ioniq 5 australia | 8.64% |

| ioniq 5 australia | 6.73% |

| hyundai ioniq 5 australia price | 3.63% |

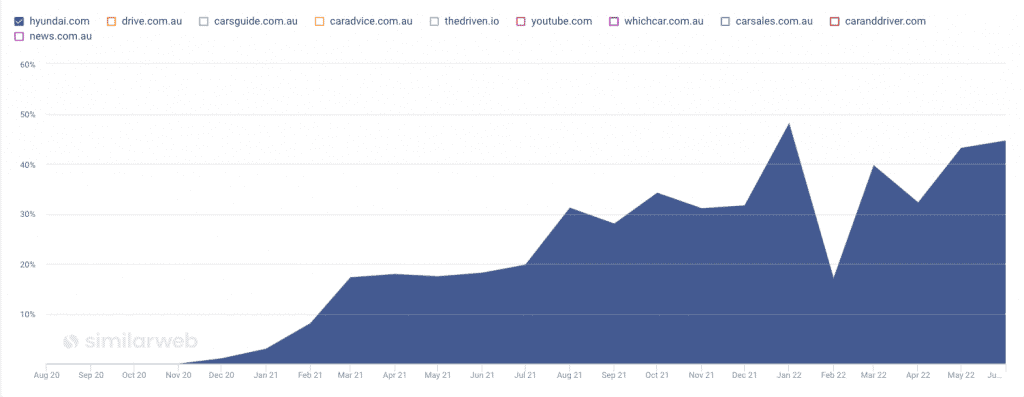

The hyundai.com site received 39.98% of all organic branded search traffic from August 2020. This is what we would class as lower funnel traffic on the path to purchase.

The upper funnel path to purchase is research. The customer is not ready to buy, but wants to learn more, and possibly take the next step. This moves them further down the funnel. In this example, the lower funnel would be visiting a dealer website to spec the car, get a price or book a test drive.

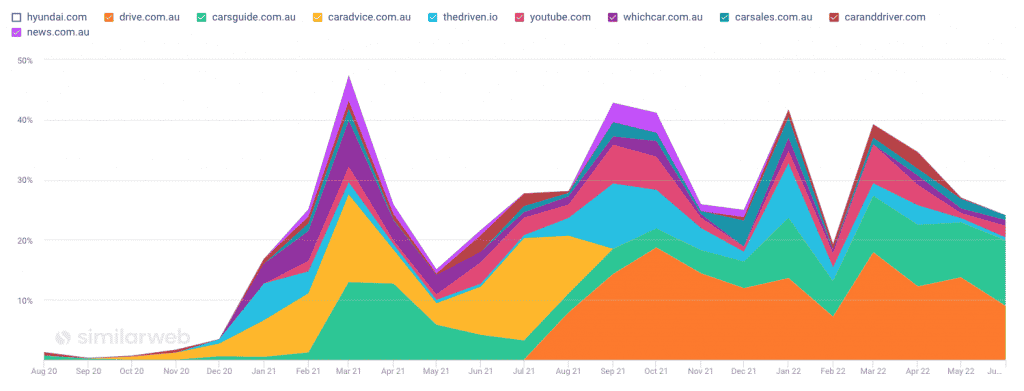

If we disregard the car manufacturer’s own website and look at the other sites at this point, things get interesting.

CarAdvice/Drive and Carsguide have the majority share of branded Hyundai search traffic; possibly not a surprise.

However, a newer car publisher, The Driven, has emerged on the Australia auto publishers list, with a 4.84% share of organic branded search traffic. In the past two years, The Driven has exploded onto the electric car review scene, increasing website traffic by 35%+ year-on-year.

Another point of interest is that websites like caranddriver.com feature at the top of the data results. This is a global car market, offering one make and model for many countries. Thus, the Australian auto audience consumes content on more websites than just the traditional ones, like CarExpert.

What does this auto trend data mean?

Using search keyword traffic data can tell you a lot about your audience. Don’t just rely on tools like Google Trends, though, as it barely skims the surface.

Whatever your industry, you can be sure that it’s constantly changing. This makes it important to use data to track and understand these changes.

If you are a brand like Hyundai, branded search traffic data will help you make informed decisions by answering these questions:

- What is your website’s share of voice/branded traffic?

- Who are your best website partners?

- How strong is your brand?

- What are your customers doing online, other than just visiting your website?

- Are you buying media from the best publishers?

At Bring, we rely on various data sources to build our research and inform the strategies we provide our customers. If you want to learn more about your brand, audience and consumers, and have a thirst for trend data packed with actionable insights, we would love to work with you.